lowes tax exempt id

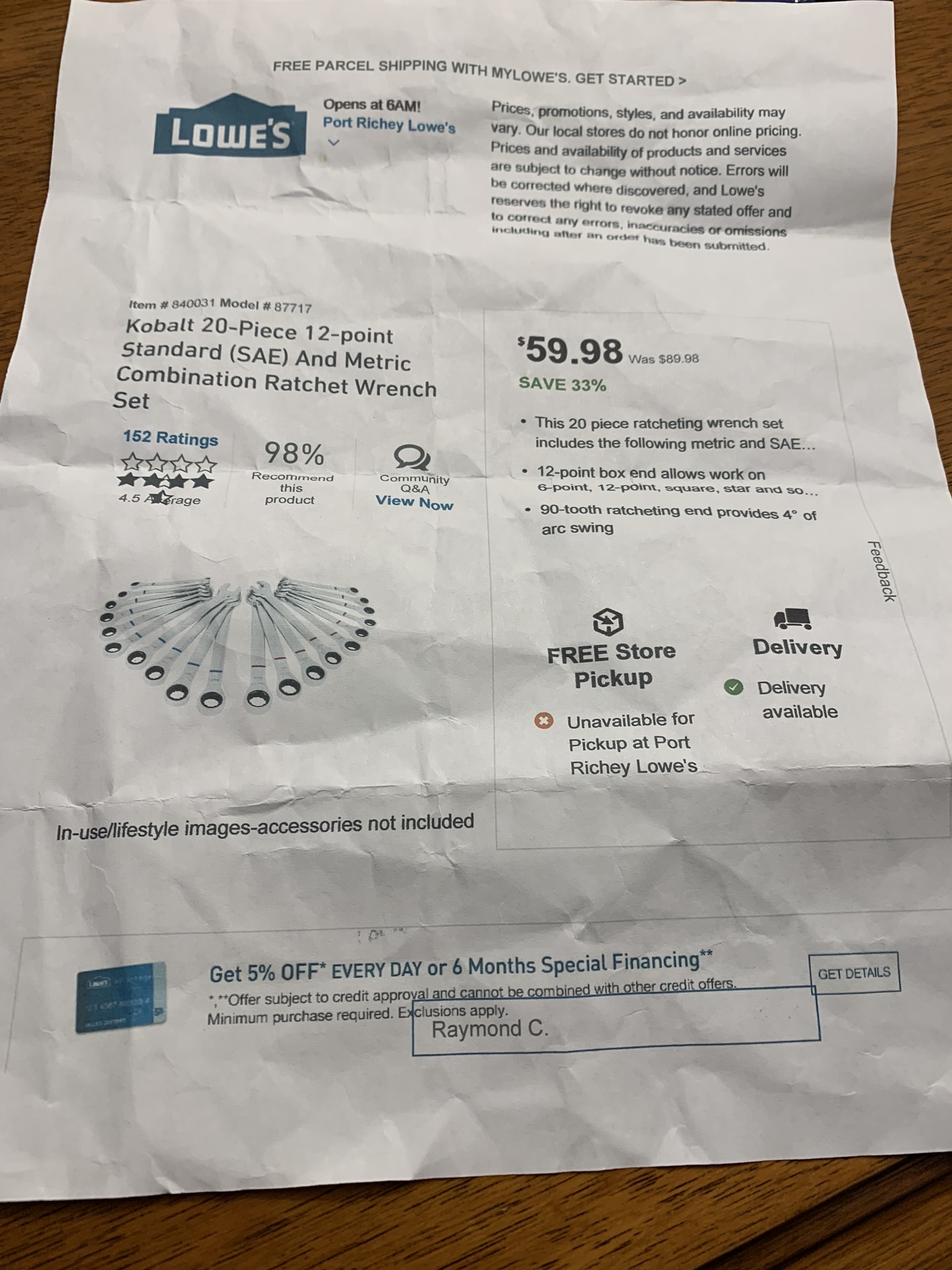

Our local stores do not honor online pricing. Lowe automotive warehouse inc 1000 camera ave suite d saint louis mo 63126.

Lowe S Proservices 5128 Escrow 2013 2022 Fill And Sign Printable Template Online Us Legal Forms

You will see your Tax Exempt ID at checkout.

. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. The tax-exempt organization should have only one EIN. Employer Identification Number EIN Tax ID Nine digit number assigned by the IRS to identify a company.

Establish your tax exempt status. You are looking for the sales and use tax resale and exemption form. Provide the state in which purchaser is located and registered.

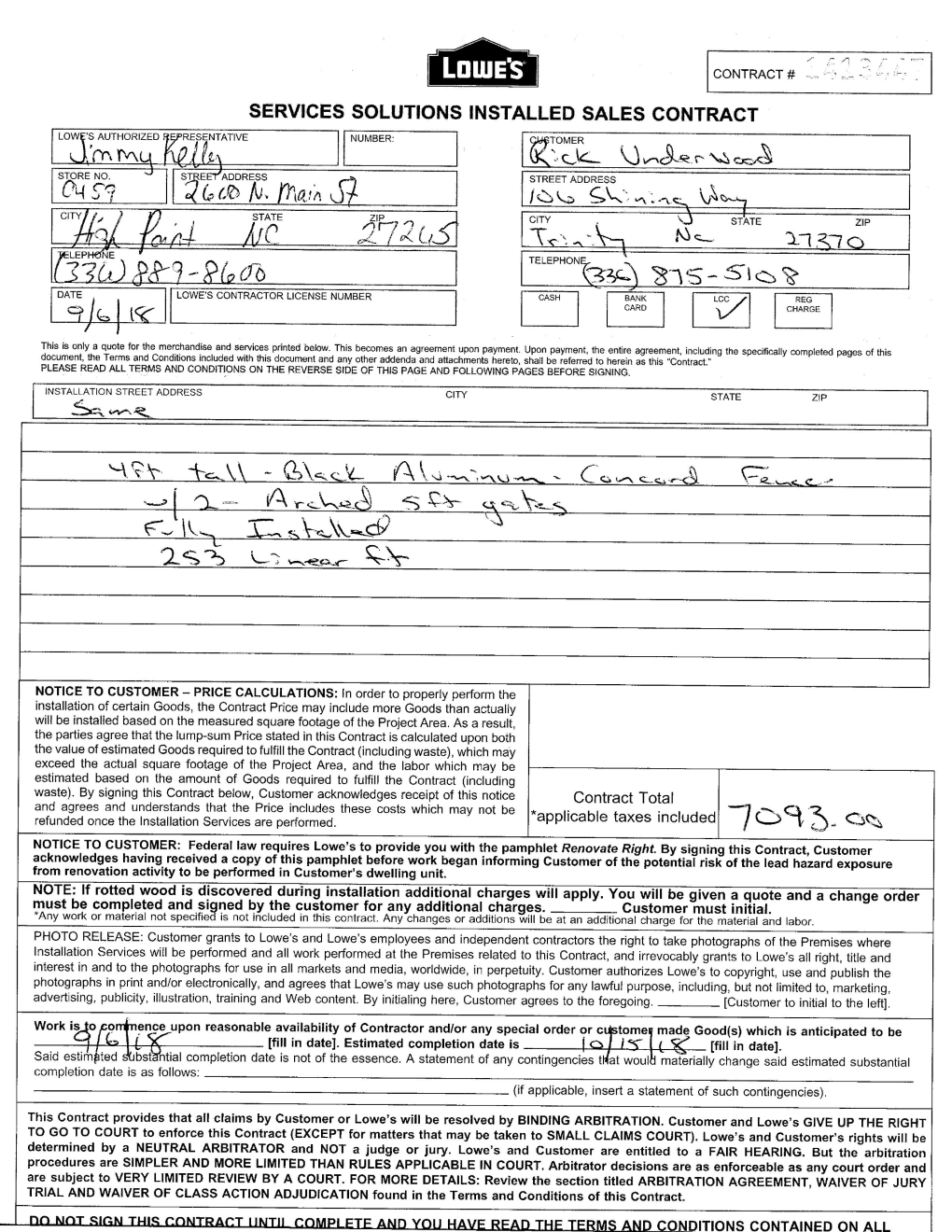

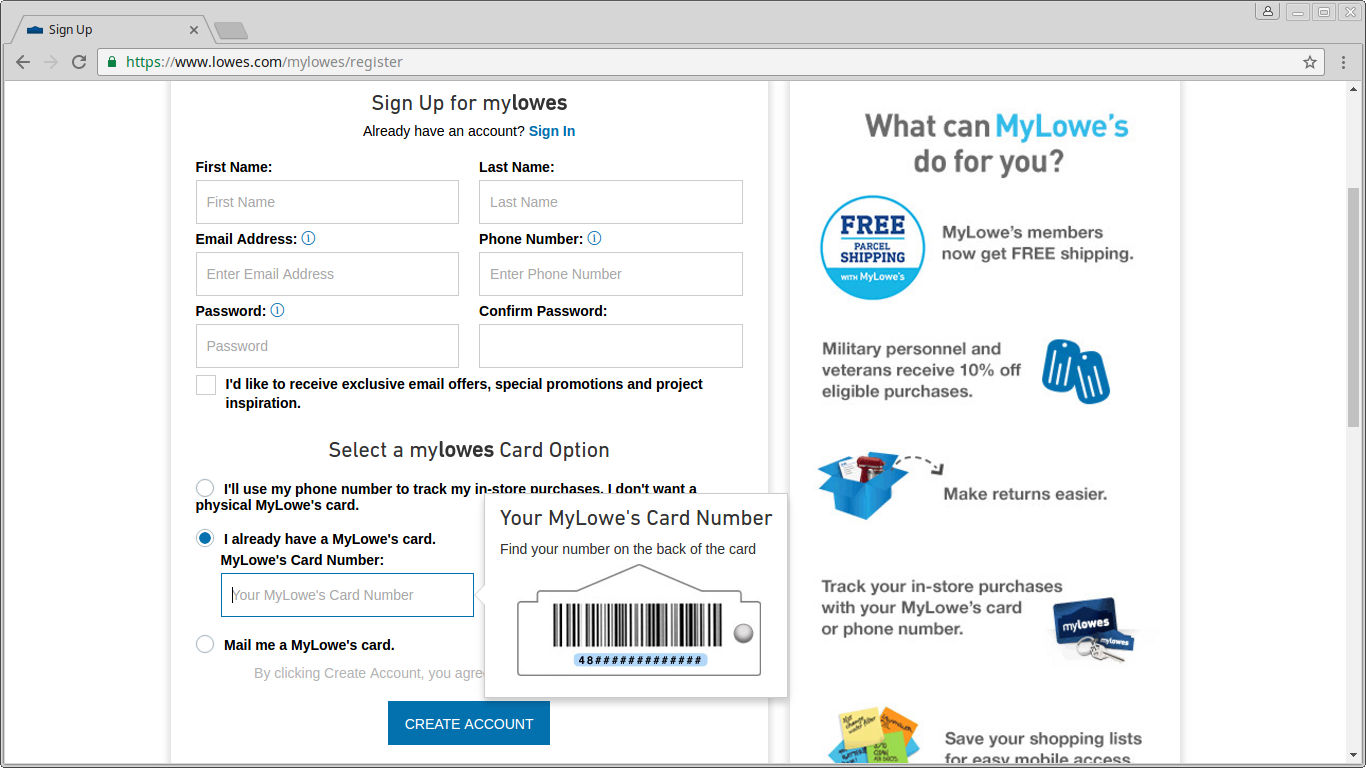

The subject line must contain the your order number. Fleet Services 9-25-2018. Tax-Exempt Management System TEMSSelect Sign In or Register in the top right cornerOnce signed in select My Account in the top right corner of the search barSelect Organization and then select Tax ExemptionsHave your local Lowes store provide your Lowes customer ID or Lowes tax IDMore items.

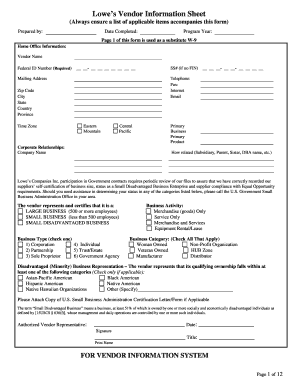

IRS EIN Taxpayer Id 56-0578072. Resale registered battery retailer missouri battery fee id number agricultural operations 7. Retail-lumber Other Building Materials Dealers.

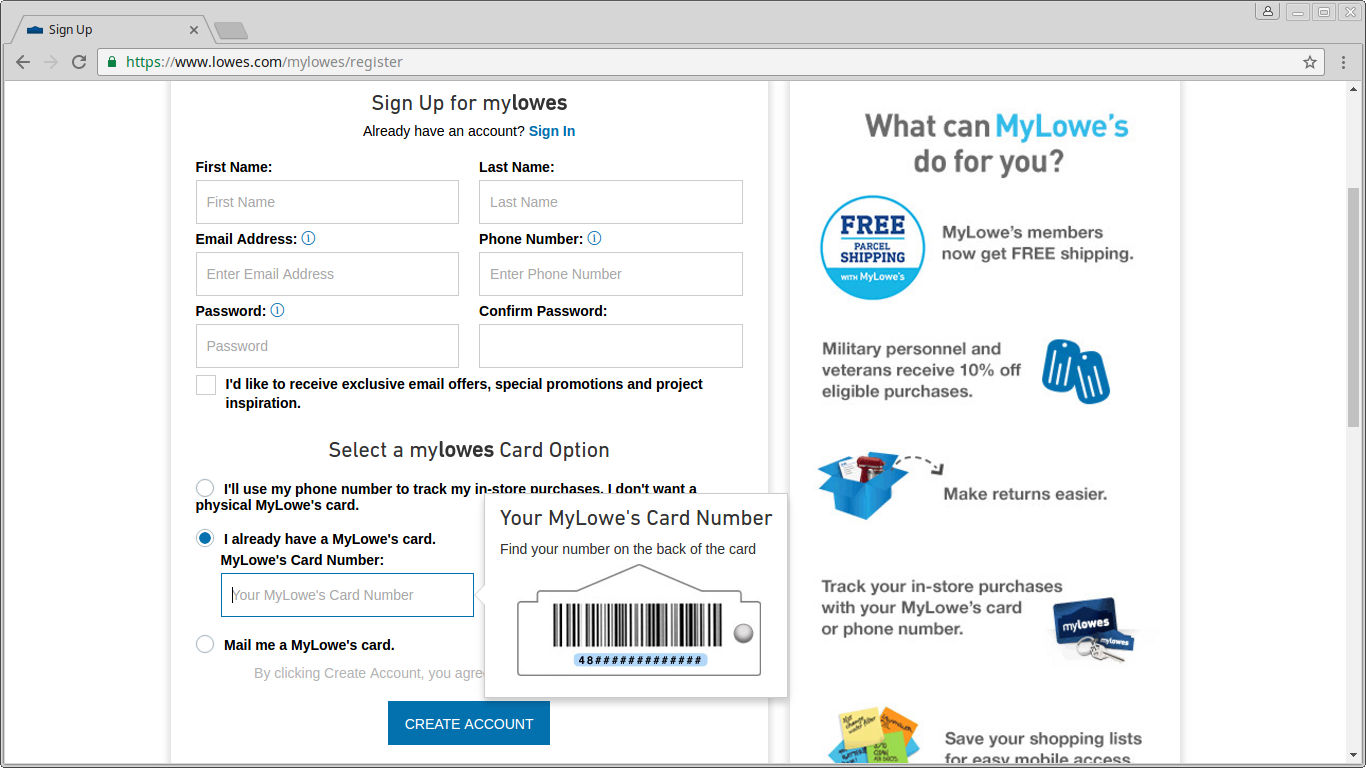

Applying for Tax Exempt Status. You will be required to enter. Conveniently manage your account or pay bills online by visiting the Lowes Credit Center.

A Missouri Tax ID Number is not required to claim this exclusion. Have your local Lowes store provide your Lowes customer ID or Lowes tax ID. When making purchases that are not tax exempt select Remove under your Tax.

Select Link Certificate and enter the TEMS ID which is the same as your Lowes customer ID or Lowes tax-exempt account ID. To use your Tax Exempt ID in stores take your registered ID number to the Pro Desk. Business Address and Contact Details.

All registrations are subject to review and approval based on state and local. Set up online access to pay your bill and manage your account online. Pro associates will help you with tax exempt purchases.

Let us know and well give you a tax exempt ID to use in our stores and online. Claiming exemption from tire fee for. Tax-exempt organizations must use their EIN if required to file employment tax returns or give tax statements to employees or annuitants.

Tax exempt purchases must be supported with a lowes tax exempt registration number. Menards Theres a bar code. Confirm that the account listed is accurate.

Easily and securely access your invoices statements pay your bill and more. Tax Tables Lowes Financial Management from wwwlowescouk All commercially prepared food with the exceptions noted within university policy 709 food service must be prepared by the. Select Tax Exemptions under the Account Details section.

ID or FEIN Number. Claiming exemption from salesuse tax for. Purchasers Home State.

When shopping online your tax exemption applies automatically to your cart. Select Link Certificate and enter the TEMS ID which is the same as your Lowes customer ID or Lowes tax-exempt account ID. As of January 5 2021 Form 1024-A applications for.

If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. If you have questions about your account call the Lowes Credit Center at 1-800-444-1408. Tax Exempt Bonds.

Are 501c3 organizations still exempt from. As of January 31 2020 Form 1023 applications for recognition of exemption must be submitted electronically online at wwwpaygov. Lowes Employee Relief Fund Inc 1000 Lowes Blvd Mooresville NC 28117-8520.

Lowes Business Credit Center. If they ask for an individual name use i3 treasurer. Is Your Business Tax Exempt.

View or make changes to your tax exemption anytime. A motor vehicle dealer who is purchasing parts for the repair of a vehicle being resold is exempt from salesuse tax. Contact treasurer if you need it.

Tax-exempt organizations are generally required to have and use an employer identification number EIN. Lowes Give our tax ID 27-0553505 and phone number 248-556-9995. Claiming exemption from lead-acid battery fee for.

Categories under which an organization may be tax exempt. Sign in with the business account you will be making tax exempt purchases with. I want to receive emails from Lowes Synchrony Bank and their affiliates Select One O Yes No If yes please provide tax exempt certificate to store Required by USA Patriot Act If you do not have one we will assume you are a sole proprietorship.

Lowes Tax Exempt. Manage your Lowes Commercial and Lowes Business Advantage account online from any device anytime anywhere. To get started well just need your Home Depot tax exempt ID number.

Tmcf Lowe S Emergency Spring Scholarship Thurgood Marshall College Fund

Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook

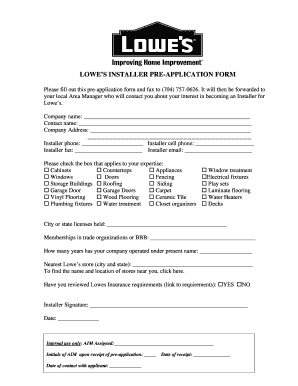

Lowe S Job Application Pdf Fill Out And Sign Printable Pdf Template Signnow

Lowes W9 Fill Online Printable Fillable Blank Pdffiller

Automate Your Lowe S In Store And Online Receipts

Lowes Corporate Complaints Number 9 Hissingkitty Com

For Jlynne123 Hope This Will Help U A Little As Cashier R Lowes

Lowes Tax Form Form Ead Faveni Edu Br

Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook