us exit tax calculation

The second way to become a covered expatriate is to have a high-enough average net income tax liability for the five tax years before the year of expatriation. The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident.

Generally if you have a net worth in excess of 2 million the exit tax will apply to you.

. By contacting a tax. Us exit tax calculation Monday March 7 2022 Edit. In 1894 Massachusetts Senator George Hoar passionately supported an exit tax declaring that The point of citizenship-based taxation is so that if an.

If a person is a US. Citizenship or long-term residency by non-citizens may trigger US. Paying exit tax ensures your taxes are settled when you cease to be a US tax resident.

The exit tax process measures income tax not yet paid and delivers a final tax bill. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. Exit tax is the IRSs last chance to tax you and is essentially taxed as if you were to sell all your assets on the last day of living in the US.

The Exit Tax Planning rules in the United States are complex. For instance an IRA. The IRS adjusts this amount each year for inflation although the Trump tax reform in 2017 changed the inflation index to a slower-growing index.

If you are covered then you will trigger the green card exit tax when you renounce your status. It applies to individuals who meet certain thresholds for annual income net worth. The expatriation date is the date an individual relinquishes US.

In order to calculate the amount of exit tax that you owe you need to file the form 8854 which is an expatriation statement that is attached to your final dual status return and works out the amount of money that you would earn on. This is the net tax liability test. The exit tax calculation.

The threshold amount for expatriations is 2017 is 162000 and it is indexed for inflation. The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. This determines the gain on your assets as well as the taxable amount of this above the threshold.

Calculating the exit tax is tricky in general but if youve got retirement accounts and foreign pensions it jumps to a whole new level of complexity. How is exit tax calculated. Citizenship or in the case of a long-term resident of the United States the date on which the individual ceases to be a lawful permanent resident of the United States Sec.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. More about that later.

Current legislation regarding an exit tax was introduced relatively recently but the idea of a US exit tax has a long history of support going back at least as far as the 19th century. The Exit Tax itself is computed as if you sold all of your worldwide assets on the day before you expatriated. The United States is not alone in having an exit tax but it is unique in tying its exit tax to a change in visa or citizenship status.

Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation 162000 for 2017 165000 for 2018 168000 for 2019 and 171000 for 2020. The expatriation tax consists of two components. In 2020 the maximum was 107600.

What Is Form 8854 The Initial And Annual Expatriation Statement 2 Green Card Holder Exit Tax 8 Year Abandonment Rule New What Is Form 8854 The Initial And Annual Expatriation Statement 3 21 3 Individual Income Tax Returns Internal Revenue Service. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card. If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you expatriate is US1200 per ounce then you have no unrealized gain and wont owe any Exit Tax.

The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. Then you are taxed on the gains. The Exit tax occurs from US.

In this first of our two-part series. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. If a Green Card Holder has been a permanent resident for at least 8 of the past 15 years they become subject to expatriation tax laws as well.

Persons at the time of expatriation from the United States. The IRS considers the present net value the type of pension or retirement account estimated accrued benefit of future distributions where the pension is held and where the work was done and thats just scratching the surface. I dont have a.

A person not excepted under either the dual-citizen or the age 18½ provision will thus need to take inventory of his or her assets in addition to assessing whether the tax-liability test has been met to assess exposure to the exit tax. Through the FEIE US expats can exclude up to 108700 of their 2021 earnings from US income tax. Currently net capital gains can be taxed as high as 238 including the net.

This is called citizenship-based taxation. In fact it does not even require that the green card holder was a permanent resident for the full 8-years or that they resided within the US. Citizen or Long-Term Resident covered expatriate the exit tax calculations kick-in.

Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return. The exit tax calculation. The recipient is also required to provide specified information to assist the covered expatriates calculation of the exit tax.

Youre going to get taxed by the IRS on that US1 million gain. At that time the covered expatriate will evaluate their potential tax liability had they sold all of their assets on the day before expatriation. The percentage of exit tax is different for everyone as it is based on your marginal tax rates.

Under certain expatriation tax rules harsh tax consequences will result if the individual giving up US citizenship or long-term permanent residency generally this is an individual who has held a. Certain individuals who give up their US citizenship or their green cards are subject to the so-called exit tax imposed under Section 877A of the Internal Revenue Code Code. The Green Card Exit Tax 8 Years analysis is comprehensive.

In some cases you can be taxed up to 30 of your total net worth.

Exit Tax In The Us Everything You Need To Know If You Re Moving

Renouncing Us Citizenship Expat Tax Professionals

Green Card Holder Exit Tax 8 Year Abandonment Rule New

When Might Renouncing Us Citizenship Make Sense From A Tax Point Of View

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

What Are The Us Exit Tax Requirements New 2022

What Are The Us Exit Tax Requirements New 2022

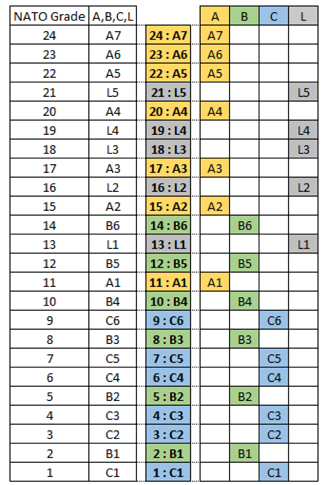

Nato General Information Working For Nato

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

Renouncing Us Citizenship Expat Tax Professionals

How To Calculate Cannabis Taxes At Your Dispensary

Taxation Of Crypto Staking Sf Tax Counsel

Exit Tax In The Us Everything You Need To Know If You Re Moving

/GettyImages-511101404-d5999c51fbd444cdba285b39a7db30d3.jpg)